Migration from license to subscription – what it takes to seize the once-in-a-decade opportunity

In 2024, it is predicted that more revenue is generated with cloud-based subscription software than with on-premises software (Statista). No surprise, subscription pricing models have been on the rise for years – not only in the software industry. What is a surprise, is that 2024 will be the first year where cloud-based subscription software overtakes traditional on-premise (and presumably license) revenues. While we all rent bikes and cars, watch movies and listen to music with monthly subscriptions, traditional license models (for which the customer pays once at the time of purchase) have dominated the software industry for years and are still around more than one would expect.

While one may stumble upon this realization, it has a positive implication for those companies that still do not monetize their product via subscription: from a monetization perspective, these companies have a once-in-a-decade opportunity in front of them! Switching from a license model to a subscription model can have a huge price effect. We will go into detail in a moment, but first things first: we are not talking about the usual “few percent price increase” every year, but about the chance to double to triple the annual recurring revenue.

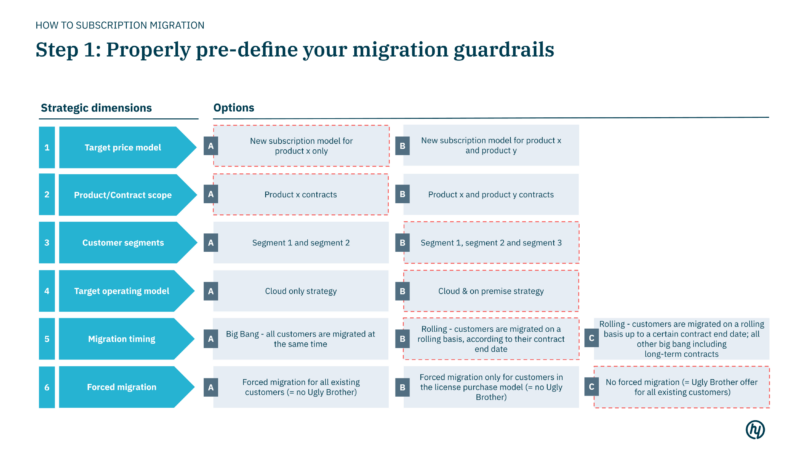

Despite the opportunity size and clear trajectory towards subscription models within the market, we often experience caution and uncertainty towards the migration to a subscription model in our work with companies. This hesitancy is not without merit, the migration from traditional licensing to subscription-based services is anything but a trivial undertaking. Here’s why:

- Business Model Transformation: Transitioning to a subscription model requires a fundamental shift in the business model. It is not just a pricing change but involves rethinking the product offering, sales strategy, customer engagement, and support structures.

- Revenue Recognition Changes: Shifting to subscriptions impacts how revenue is recognized. In a traditional licensing model, revenue is recognized upfront, while in a subscription model, it is recognized over the period of the subscription. Depending on the proportion of new customers, this change to a subscription model can lead to short-term revenue dips and affect cash flow.

- Customer Perception and Acceptance: Some customers may be hesitant to change, particularly if they are accustomed to a one-time purchase model. They might perceive the subscription model as more expensive over time or be wary of ongoing commitments. Convincing customers of the long-term benefits and value of a subscription model can be challenging.

- Pricing Strategy Complexity: Determining the right pricing for a subscription model can be complex. It involves understanding customer value perception, competitive pricing, and customer segmentation.

- Sales and Compensation Structure Changes: Sales strategies and compensation structures that were effective for one-time sales may not align with subscription sales. This shift necessitates retraining sales representatives and restructuring sales incentives to focus on recurring revenue and customer retention.

- Cultural Shift: Internally, there may be resistance to change from employees accustomed to the traditional model. Cultivating a company culture that embraces and adapts to the subscription model is crucial for a successful transition.

That being said, a subscription migration requires careful planning and clean execution. But no worries, we have got you covered. We are here to help!

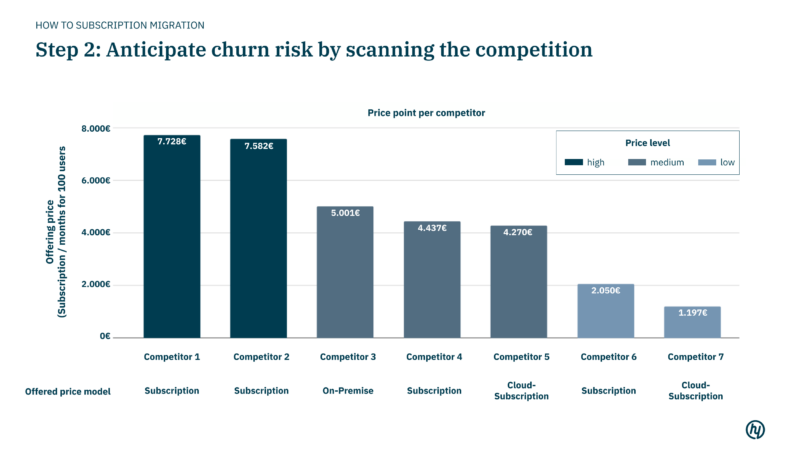

Step 2: Anticipate churn risk by scanning the competition

Minimizing churn is paramount. One of the major churn drivers is the potential offer your client will receive from any competitor. Therefore, the competitive position against major market players must be understood. This understanding serves as the basis for calibrating your migration offer and ensures that you are not at a structural disadvantage.

It is important to bear in mind that your customers will inevitably compare offerings, and they do receive new customer offers from your competitors. In scenarios where lock-in effects play only a minor role, you need to develop an offering that not only matches but exceeds the attractiveness of your competitors’ offerings. This competitive advantage is the linchpin for securing customer loyalty and minimizing the churn risk during the migration process.

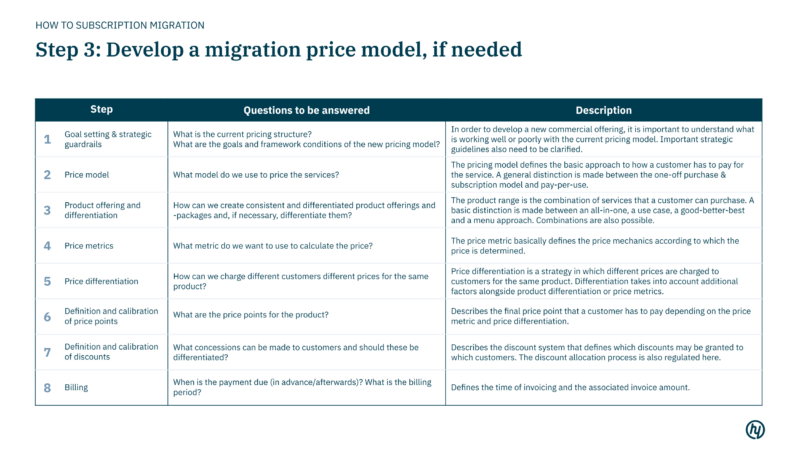

Step 3: Develop a migration price model, if needed

It is essential to recognize that not every existing price model can seamlessly transition. The experience underscores the significance of the price model itself. In fact, the structure of pricing can be just as influential, if not more so, in determining the take-rate as the actual price point.

To tackle this challenge, each component of a price model must be challenged. There are a number of questions to be answered: What is the product offering and how will it be differentiated? What metric is used to calculate the price? How can we charge different customers different prices for the same product? And what are the final price points for the product, how are discounts differentiated and what does the billing process look like? By answering these questions, you ensure to build an aligned subscription price model and thus, a smooth and successful transition to subscription-based pricing.

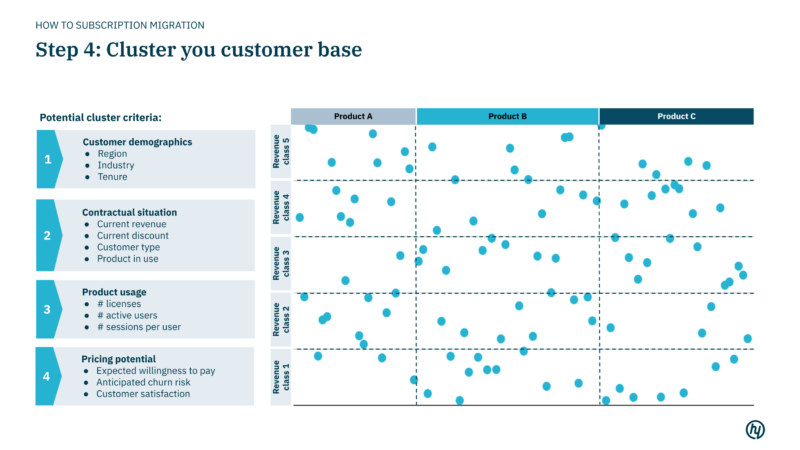

Step 4: Cluster your customer base

Customer reactions to the introduction of subscription models differ vastly, leading to differences in willingness to pay and churn risk. By defining specific customer clusters for the migration, fine-tune your tactics and price points according to the unique characteristics of each cluster. This targeted approach ensures that customer responses are optimized, mitigating potential churn risks.

It is imperative to exercise caution when clustering, and consider what we refer to as “sleeping dogs.” Every company has some customers who are better left untouched, as even minor modifications have the potential to trigger churn. To create an effective clustering strategy, attention to detail is key. It is often wiser to invest additional time to refine your clustering methodology and rather introduce an extra cluster for individualized treatment than one less. This approach ensures that no stone is left unturned, paving the way for a smoother and more successful migration journey.

Step 5: Spend most of the time on developing migration tactics

Once specific customer clusters are defined, the next move involves crafting a compelling set of migration incentives, detailed out for customer-individual use. Customers’ perspectives on the subscription model are highly diverse, and, as such, the incentives must reflect this diversity. For some, additional features and services serve the case. Others may find financial discounts to be the deciding factor in their transition. One of the commonly used tactics is what we fondly refer to as the “ugly brother” approach — an unattractive alternative to the subscription offering. This can sometimes be a powerful motivator, as this alternative underscores the benefits of the subscription model. Moreover, do not underestimate the potential of contractual leverage, e.g. when the contract allows for discontinuation of certain services.

When it comes to price negotiation, the negotiation toolkit encompasses both proactive and reactive incentives. Proactive incentives are already communicated in the written offer, while reactive incentives can be used by the sales team on a customer-specific basis and as required. This holistic approach ensures that the sales team is well-equipped to engage with customers at every stage of their migration journey, ultimately leading to higher success rates and customer satisfaction.

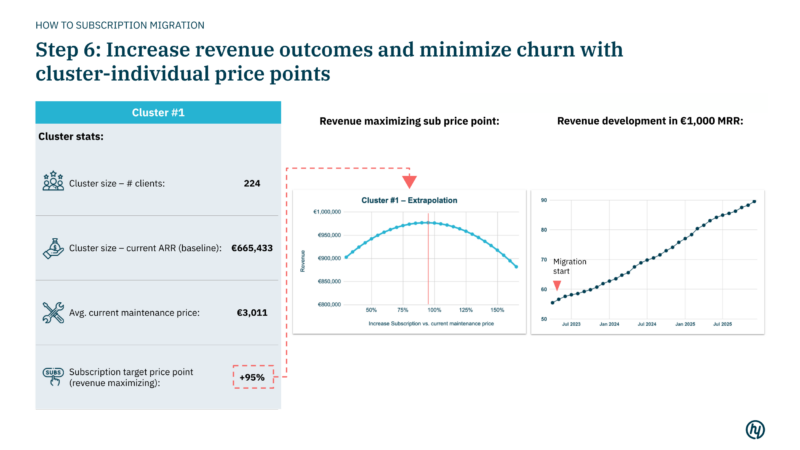

Step 6: Increase revenue outcomes and minimize churn with cluster-individual price points

With data and price-finding methodology as the guiding lights, the next crucial step is to develop EBITDA-optimal subscription migration price points tailored to each customer’s unique profile.

Customers often exhibit a wide range of price sensitivities, with varying degrees of willingness to pay for the subscription. Simultaneously, the existing ongoing (maintenance) pricing landscape is inherently diverse. This disparity underscores the necessity for customer-specific price calculations.

To achieve this, a spectrum of well-established methodologies can be employed. These may encompass customer or expert interviews, robust regression analyses, or the utilization of sophisticated pricing market research methods. By applying these techniques, nuanced insights are unearthed, enabling the calibration of price points that not only maximize EBITDA but also resonate with each customer’s specific preferences and needs.

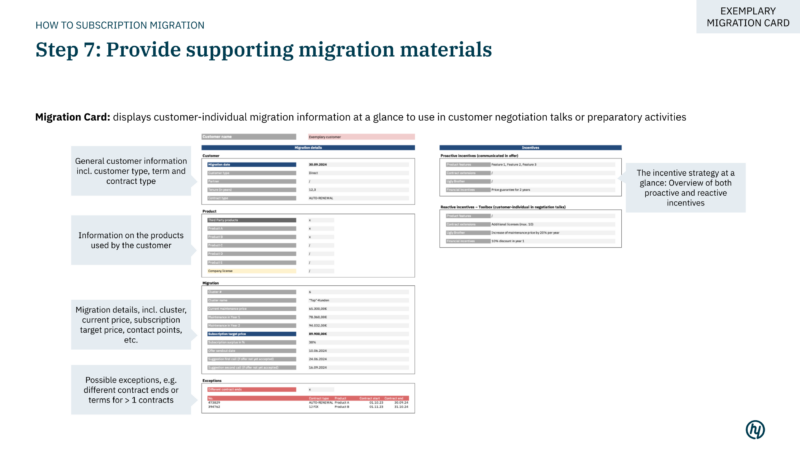

Step 7: Provide supporting migration materials

In the face of a substantial price increase, the importance of robust supporting materials cannot be overstated. These materials play a dual role, serving both your sales team and your customers. Elements such as a clear mission statement, a forward-looking product roadmap, tailored customer-specific offers and emails, persuasive sales arguments, comprehensive Sales FAQs, and strategic negotiation battlecards are invaluable tools in boosting adoption rates.

It is essential to bear in mind that different customer groups may have varying needs and expectations. Some customers may be managed by partners. In such cases, it’s critical to carefully consider your approach and provide the necessary materials to empower your partners. This collaborative effort ensures that your transition strategy is not only effective but also responsive to the diverse needs of your customer base.

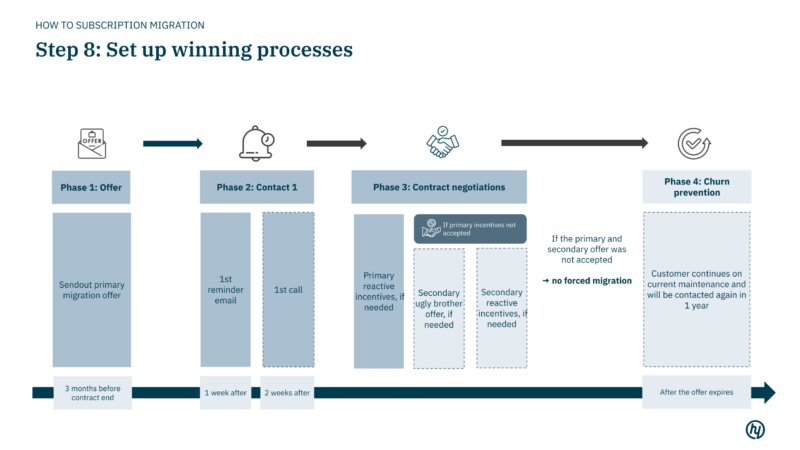

Step 8: Set up winning processes

True success is measured by the effectiveness of the implementation phase. This hinges on the formulation of a winning migration process — one that orchestrates the seamless transition from strategy to execution.

Key aspects of this process encompass the timing of the new offer sendout, the timing and approach by which sales representatives engage customers for negotiations, and the identification of other crucial touchpoints.

Moreover, it entails the definition of an escalation process, specifying discount allowances, and clarifying the approval hierarchy. It is important to account for potential exceptions within the customer base, acknowledging that not all scenarios fit a one-size-fits-all mold.

Lastly, an effective migration process incorporates a structured meeting cadence. This may include scoping meetings to define the migration cohort, retrospectives to evaluate progress, and best practice sharing sessions to facilitate ongoing improvement and knowledge exchange. These elements collectively ensure that the migration does not just remain a strategy on paper but manifests as a successful reality in practice.

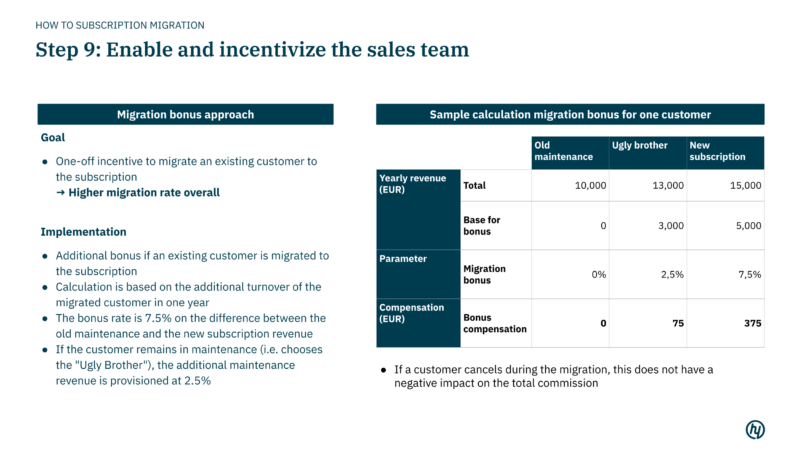

Step 9: Enable and incentivize the sales team

Given the inherent challenges of subscription migration, it is essential to empower your sales team to effectively handle potentially difficult conversations. This entails comprehensive training, equipping them with the tools, arguments, materials, and incentives necessary to address customer feedback adeptly.

Furthermore, recognize that the migration process can be demanding. To maintain team motivation and dedication, it is crucial to provide significant incentives that inspire the team to embrace the additional workload. In the realm of incentivization, the motto should be “race to the top” rather than “race to the bottom.” A subscription migration calls for bold incentives; it is an initial investment that promises substantial returns in the long run. Incentives should be tied to the base customer value of each sales representative and measured based on subscription enforcement rates. This aligns incentives with the ultimate goal of driving successful migrations.

Lastly, it is important to cultivate the right organizational culture. Lead by example, with the leadership team actively participating in the migration process. Their direct involvement, for example migrating the first 10 customers themselves, can significantly boost the motivation of the sales team. And when the subscription launch arrives, make sure to celebrate it as a significant occasion, marking the beginning of a new era.

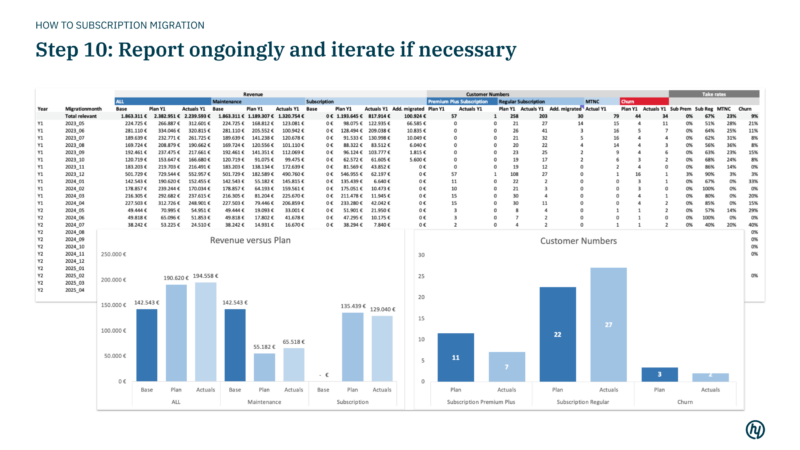

Step 10: Report ongoingly and iterate if necessary

In the world of a migration, it is vital to acknowledge that no ex-ante validation is flawless. Consequently, you must be equipped to make ongoing adjustments to migration prices and tactics as circumstances demand. The ability to continuously understand and respond to the evolving migration landscape in real-time is paramount.To facilitate this agility, a performance dashboard that empowers you to stay attuned to the nuances of the migration journey is crucial. This tool not only keeps you informed but also provides the means to fine-tune migration prices, ensuring they align with EBITDA-optimal price points. It is through this dynamic approach that your migration strategy remains adaptable, effective, and responsive to the ever-changing landscape.

Bonus: Make sure your organization is ready for the transition

Last but not least, one of the pivotal success factors lies in ensuring that your organization is well-prepared for this transformative journey. Here are key considerations that illuminate the importance of organizational readiness:

- Timing Is Everything:

When your organization is in the midst of significant change, such as a merger or recent restructuring, it may be wise to postpone your pricing project by half a year or more. Why? The migration to a subscription model entails a substantial amount of work, a shift in the way the sales team operates, and a demand for strong leadership. If the organization is already busy with other pressing issues or if there is a lack of trust in leadership, the migration effort is at risk of failing. Stability and confidence are fundamental prerequisites for success.

2. Data Quality Matters:

An essential foundation for a successful migration is having accurate and high-quality data. Without it, defining migration tactics and individual price points tailored to customer clusters becomes a dangerous endeavor. What data is required? Ensure you have a comprehensive dataset that includes a full list of customer/contract data, including essential parameters like current price point(s), product/feature set, number of licenses etc. to support informed decision-making.

3. Rely on a Strong (and Experienced) Sales Team:

Customer negotiations during the migration can be complex and challenging. Experienced sales representatives who are accustomed to handling challenges and complexities are essential. While having an experienced team is ideal, well-planned training can also prepare a junior but highly motivated team to navigate the migration journey effectively.

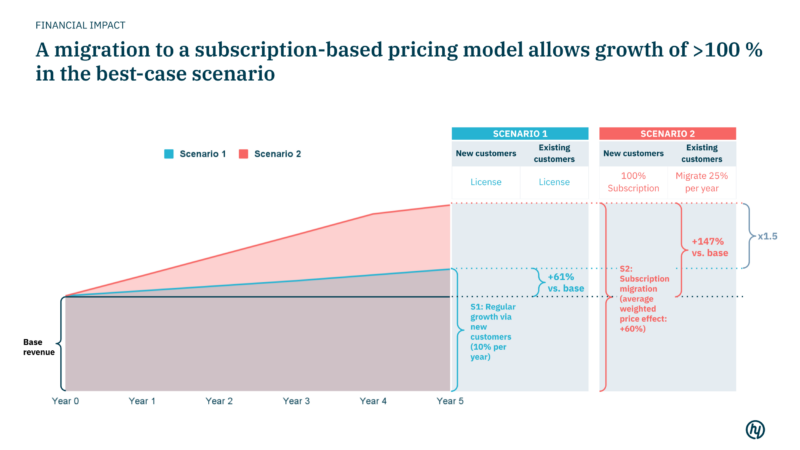

Financial impact – a once-in-a-decade opportunity?

The migration process can be draining, however, from a financial perspective, it will be worth it. When examining monetization models purely from a financial perspective, the long-term profitability of the subscription model becomes abundantly clear.

When implementing conventional incremental price increases or minor adjustments to pricing models, one might anticipate price effects ranging from 3 to 25%. However, when dealing with a subscription migration, we talk about doubling to tripling annual recurring revenues. Our calculation serves as a demonstration of this opportunity:

- Continuing the license-based business over five years with a consistent annual customer growth of 10% yields a revenue growth of +61% (Scenario 1).

- Conversely, if the company opts to exclusively offer the subscription model to new customers over the same period while concurrently migrating all existing customers steadily to this subscription model over four years (assuming an average weighted price effect of +60% vs. current maintenance price), the company elevates its revenue to 2.5 times the original (Scenario 2). Notably, this revenue is also 100% recurring.

- Comparing both scenarios in the fifth year, the company embracing the subscription model earns 1.5 times more than its counterpart continuing with the licensing model.

As a result, we can conclude that the migration to a subscription-based business model is an incredibly promising opportunity – in fact a once-in-a-decade opportunity.

It’s time

Many software companies do not yet use a subscription model. As surprising as this is, the opportunity is a positive one. Rarely does a company have such a large monetization lever at its disposal, even if it is admittedly not trivial to implement. However, this migration of the business model can succeed with a dedicated approach to the concept on the one hand and a detailed and customer-specific implementation strategy on the other, and the company’s revenue and EBITDA can be significantly increased as a result. We are here to help you on your journey towards subscription.

We have covered the topic in the Pricing Friends podcast as well. Check out the episodes with Timo Müller (Senior Advisor at hy), Dr. Andreas Spiegel (Founder at DRS Investment SE), and Patrick Katenkamp (Value Creation Partner at Elvaston) for more insights into the subscription migration topic.