Synergy Over Competition

The Future of Investing and Partnering in Innovation Management

Innovation is nothing less than the ability to survive in changing times. The pressure on companies to innovate is high due to global crises, supply chain issues, rising energy costs, and a shortage of skilled workers. At the same time, the enormous economic pressure forces decision-makers to cut budgets, which often materialize in the innovation sector. This is a problem that those responsible for innovation across various industries can relate to.

Innovative Approaches Under Scrutiny

Over the past decade, companies have built extensive innovation structures. In our Corporate Innovation Report (link to report), we surveyed more than 100 innovation leaders in Germany in the summer of 2023. Over 90 percentage of the surveyed companies have been pursuing multiple modes of corporate venturing through their own subsidiaries and dedicated vehicles since 2013. However, less than half believe these structures are sustainable for the future. Remarkably, three-quarters of the respondents see great potential in combining different modes. The selection of the right structures to complement each other will thus be the key to success.

One of the most popular modes of corporate venturing remains Corporate Venture Capital (CVC), either via a business unit or even as a separate subsidiary with VC-like structures. Not necessarily new, but still widely discussed, is the use of Venture Clienting as a partnership vehicle to promote cost-effective solutions through collaboration with startups. In times of budget cuts in innovation management, both modes are often compared. Gregor Gimmy, the pioneer of the Venture Client model, even lists reasons in his book “Kaufen statt investieren! Wie Sie mit dem Venture-Client-Modell Start-ups strategisch nutzen” why innovation managers should prefer the Venture Client model over investing through CVC (2022, pp. 29 ff.). However, our project experience shows that achieving individual innovation goals is not about an “either-or” approach, but about clearly defined objectives.

Investing vs. Partnering: What is the New Black?

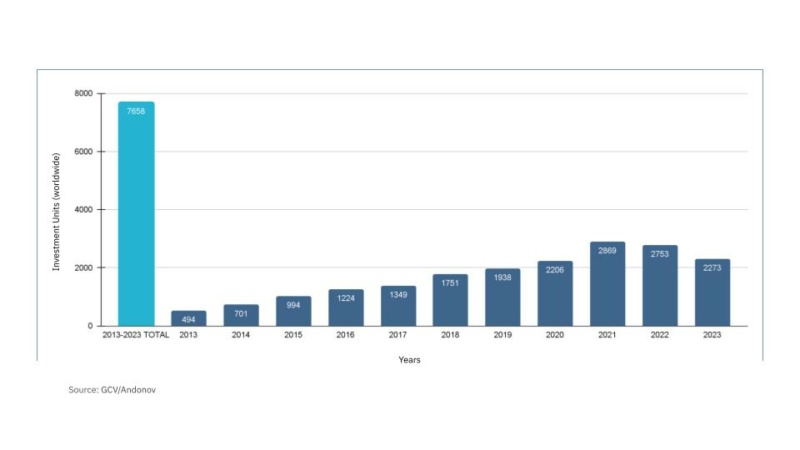

CVC has been one of the most well-known modes of external corporate venturing in the past decade. The number of corporate investment units worldwide has increased from 494 in 2013 to a total of 2,273 units in 2023, a 360 percent increase (Andonov, 2024). Investing vs. Partnering: What is the new black?

However, many companies have come to realize that CVC is a long-term and primarily financially motivated game, capital-intensive and with relatively high strategic risk. Startups change their products and business models frequently, requiring investors to have patience. Only a diversified portfolio that can withstand the industry’s typical failure rate will lead to success. A close attachment to individual use cases and pilot projects often results in shattered dreams.

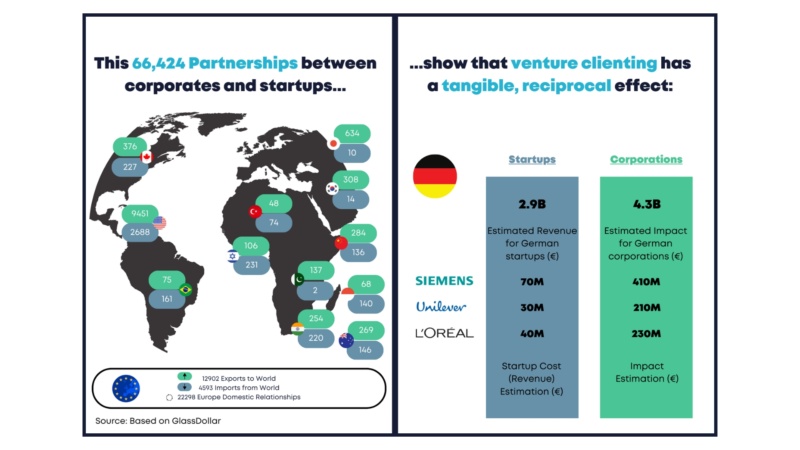

In contrast, partnering is a relatively new innovation mechanism, for which there are no data on worldwide prevalence yet. However, it has already proven its legitimacy, as German Venture Clienting units have generated an estimated €4.3 billion with their pilots (Dudek et al., 2023). The company, known as the Venture Client, acquires the startup’s product or service at an early development stage and validates its feasibility in a pilot project under real conditions.

A few years ago, CVC was a popular approach due to its promise of financial and strategic returns. However, today, it seems that partnering is taking the lead. Leaner, less capital-intensive, and immediately focused on direct applications within the parent organization, its appeal is strong.

The problem is that investment and partnership typically do not occur simultaneously but are often separated by investment rounds. Investment units tasked with scouting startups suitable for both investment and partnership often find themselves in a vicious cycle: the deal flow is too biased, processes take too long due to the necessary internal validation with experts, early-stage startups lack the necessary personnel and technical resources to collaborate directly with large corporations, and the quality of the investment portfolio declines.

In contrast, partnering promises quick solutions for identified needs. However, it offers little protection against disruption and access to emerging markets. Both approaches must also overcome the “not invented here” dilemma when it comes to actual collaboration, managing cultural differences, and building transformative power.

#hythought:

Don’t follow the herd. The individual assessment of a company’s problems and questions is crucial before creating or dismantling units.

A Matter of Objectives: How to Successfully Combine Partnering and Investing

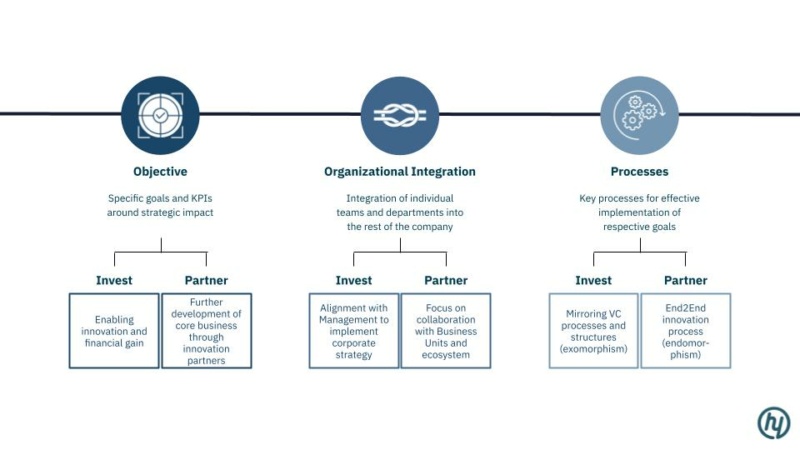

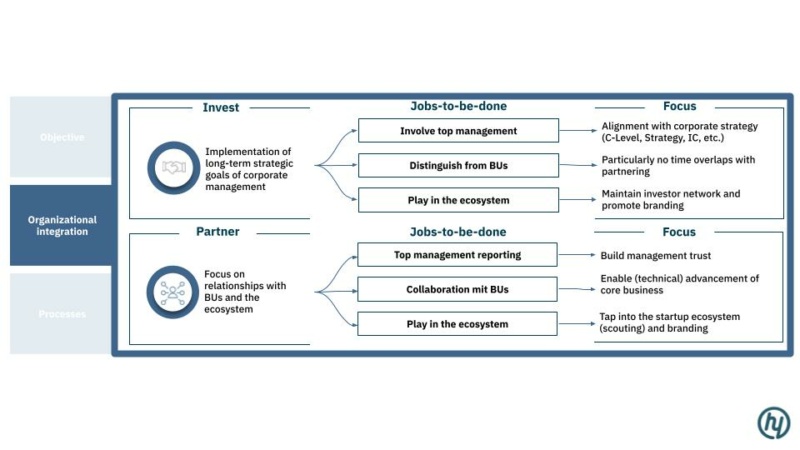

Partnering and investing can complement each other greatly if goals, organizational integration, and processes are properly aligned.

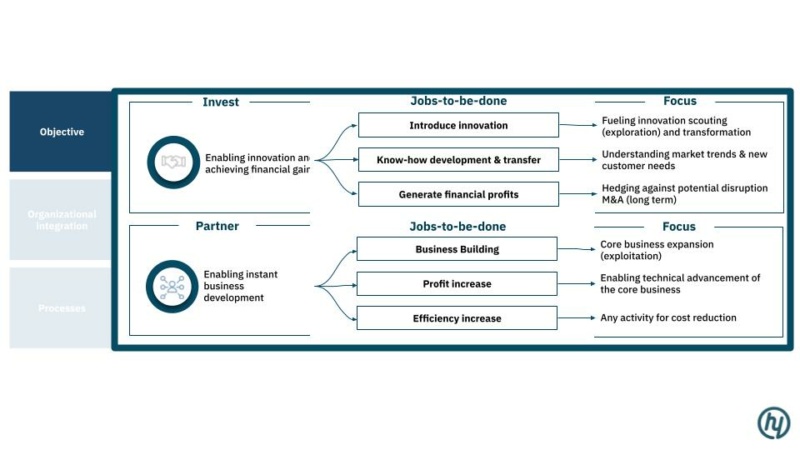

While investment units are explicitly tasked with generating financial returns, maintaining a long-term focus on market changes and product innovation, and ensuring high-quality deal flow and portfolios, the mandate for partnering approaches is the development and optimization of the core business in the present or near future.

Strict organizational separation of partnering and investing is necessary; otherwise, there is a risk that the opposing directions of the two modes will lead to mutual failure due to operational entanglement. Conflicts of interest arise when opposing approaches are combined, though this does not affect the transfer of knowledge between units and the exchange of potentially exciting startups.

#hythought:

Even if the units are separate, a shared CRM system is recommended. This ensures coordinated collaboration with the external ecosystem, prevents duplicate outreach, and provides clarity regarding points of contact.

To prevent organizational (and operational) overlap, partnerships and investments should engage relevant stakeholders differently according to their goals. Investment units require mutual exchange with the C-level of the parent organization to derive crucial search vectors from the company’s strategy. Additionally, they must inform the C-level about the ecosystem (“What’s happening out there? What will soon be relevant for us as a company?”).

#hythought:

Information from board seats must be kept strictly confidential, with Chinese Walls in place within the parent organization. At the same time, aggregated insights from various board seats can be summarized and provided to the C-level as exclusive market insights without revealing specific details about individual startups.

Partnering, on the other hand, needs close integration with the operational business and buy-in from the business units. Scouting mechanisms must be established in close collaboration with key leaders across the organization to ensure the immediate application of products and successful pilot projects.

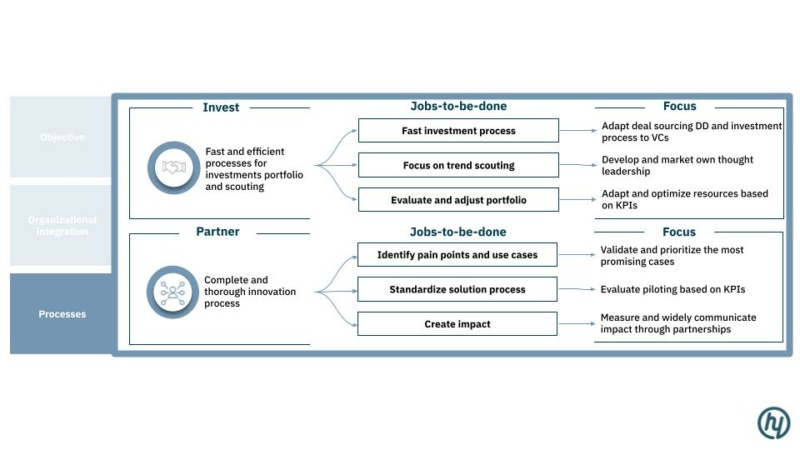

The key processes differ significantly between partnering and investing and thus require different professional competencies. While investment units must focus on financial expertise, trustworthy access to the VC ecosystem for co-investments, negotiation skills, and speed, partnering requires engaging the internal network within the parent organization. Essential competencies for partnering include knowledge of the core business and a streamlined approach to internal processes such as legal, compliance, and procurement.

#hythought:

One team fits all is not an effective solution. Investment units can provide strategic value to their portfolio by opening doors within the parent organization. The expectation that investments will primarily lead to partnerships often fails.

Closing Remarks: So What?

In the end, the question is “So what?”. Over the past two years, we have had the privilege of assisting many clients from various industries in reorganizing their innovation portfolios. Our recommendations varied greatly depending on the actual objectives and problems of the company. For some companies, the coexistence of partnering and investing made sense, and we helped them clearly separate the structures in terms of organizational integration and expectations. For other organizations, we clearly recommended pursuing only one of the two paths.

Would you like to learn more about which innovation approach – Investing or Partnering – can deliver the best strategic results for your company? We are happy to help you identify and implement the optimal strategies for your goals. Contact us for more information.