ESG+ Tech Stack 2025: How tech startups are accelerating corporate sustainability approaches

Sustainability strategists find it difficult to carry out a structured and future-oriented screening of potential and needs in order to set strategic priorities and drive forward sustainable innovations in a targeted manner – we see this in our daily work and in intensive discussions.

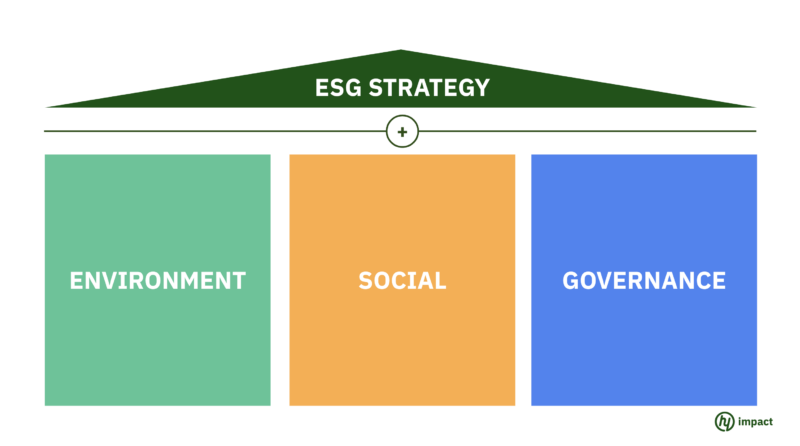

In order to better understand how the market and solution environment is developing, we have decoded the corporate sustainability startup ecosystem according to the ESG model (environment, social and governance) and identified key growth areas. In doing so, we realized that the ESG model is no longer sufficient today. In the wake of increasing complexity due to changing consumer needs and stricter laws, a new category of startups is currently emerging – ESG strategy solutions, the “plus” in ESG+. They stand like an umbrella over the three ESG pillars and offer corporate sustainability managers solutions for their overall strategic issues.

Why it’s worth taking a look at the startup ecosystem, especially for corporate sustainability drivers!

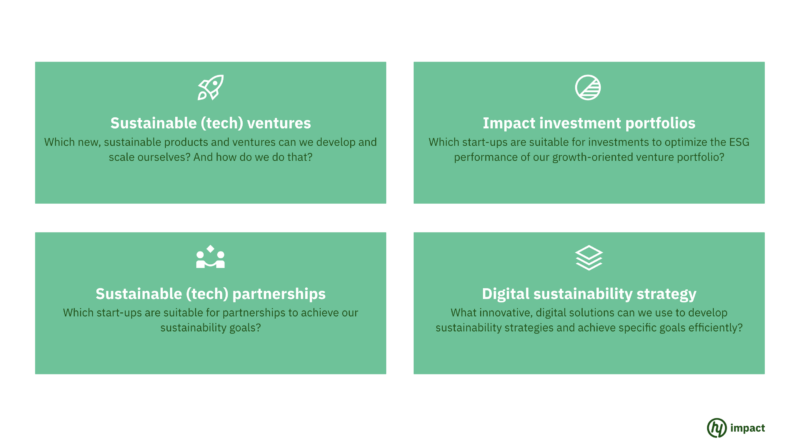

The legislation leaves little room for maneuver: with the Corporate Sustainability Reporting Directive (2022), the number of German companies that are obliged to report on sustainability will increase from 550 to 15,000 in 2026 (Source). This cross-industry, collective pressure to innovate in the field of corporate sustainability has caused ESG+ startups to sprout up like mushrooms, developing innovative, mostly digital solutions and hoping for high ROIs. A look at the startup ecosystem helps corporate sustainability managers with the following strategic questions:

Many companies have already put their products and business practices to the test and are driving the transformation towards a reduced energy demand from renewable energies and the reduction of their carbon footprint. In some cases, the strategic focus is increasingly on the development of new sustainable products and ventures in these areas.

#hythought:

Managers need to strategically integrate growth and sustainability and those who not only want to “put out fires” but also actively convert sustainability into ROI must drive innovation now. Analyzing startup foundations and investments in the ESG+ startup ecosystem helps to identify concrete sustainability innovation fields and solution spaces.

ESG+ decoded – corporate sustainability is more than just green!

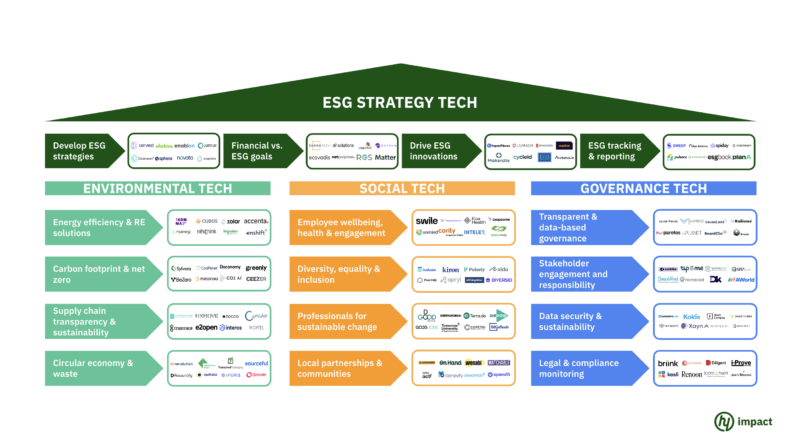

Within the ESG Strategy Tech startups, the analysis of VC investment flows shows that startups primarily raise large amounts of funding when they use modern technologies to help companies develop holistic ESG strategies, align financial and ESG goals, drive ESG innovations and help with ESG performance measurement and reporting.

Looking at the Environmental Tech startups, the solutions that currently stand out are those that support energy transformation, carbon footprint reduction, sustainable supply chain optimization and the implementation of circular economy approaches.

Social tech startups are comparatively the least targeted by VCs within the ESG+ model. Nevertheless, smaller but emerging startup segments can be identified that focus on employee wellbeing, DEI (diversity, equity and inclusion), employee training and local partnerships/corporate volunteering.

Governance tech startups, which are currently on the upswing, deal with data-based management decisions, stakeholder engagement, data security and automated legal monitoring.

#hythought:

We have summarized an overview of relevant issues and corresponding solutions from the startup ecosystem as an ESG+ tech stack.

Exemplary, innovative startups

As part of our analysis, we were able to identify various change vectors within the ESG+ startup ecosystem and derive specific sustainability innovation fields in the area of corporate sustainability in which VCs are placing their trust. Here are two examples that one or the other may have already discussed in a work context?

ESG+ innovation field #1: Corporates face the challenge of eliminating conflicts between the financial and environmental/social target dimensions.

One issue that Oxford University predicted back in 2015 and is now causing companies increasing headaches is their cost of capital (source). More and more investors are also analyzing the sustainability standards of potential borrowers – making sustainability essential for anyone who wants to keep interest rates low. A new solution from the ESG Strategy Startup segment is Net Purpose – founded in London in 2019 – which has already raised €16.17 million in VC funding. The platform measures the impact of investments, visualizes the results in reports and thus creates a solid, data-based decision-making basis for ESG initiatives that also deliver an ROI. Leading global asset managers with a total investment volume of over USD 5 trillion now use the Net Purpose platform. (Source)

ESG+ innovation field #2: Corporates are increasingly facing the challenge of implementing regulatory requirements to reduce their carbon footprints, such as the EU Climate Law, the Corporate Sustainability Reporting Directive (CSRD) and the German Climate Protection Act.

When it comes to CO₂ reduction, corporates are being driven particularly strongly by legislation and are coming under increasing pressure. One solution is from the environmental startup segment. Innovative start-ups, such as Ceezer, are trying to provide a remedy. Ceezer was founded in Berlin in 2021 and has already received €15.53 million in funding. They offer a platform that gives corporates direct access to high-quality CO₂ offsetting projects and flexible trading options for CO₂ certificates. The platform supports spot, forward and long-term purchases, enables the risk-optimized achievement of CO₂ targets and creates a strategic data basis for compliance with regulatory requirements. With a broad network of offsetting projects and extensive analysis functions, Ceezer offers a flexible and data-based solution for CO₂ offsetting. Well-known companies such as Telekom and Siemens already rely on Ceezer’s services to implement their CO₂ reduction strategies. (Source)

Survival of the fittest – corporate sustainability as a means of ensuring survival

We are convinced that sustainability will play a similarly transformative role in the coming decades as digitalization and now AI, force companies to assume environmental and social responsibility in order to survive in the market. Regulatory-driven companies in particular need to address the question of how they want to position themselves in the future as quickly as possible.

#hythought:

Those who transform sustainability into ROI in corporate sustainability now will have an unfair competitive advantage in the coming decades that will be difficult to catch up on. Everyone else will struggle to survive.

Would you like to discuss this topic or are you looking for support in building the right tech stack? Get in touch.