Stablecoins – increased efficiency and cost savings for global transactions

The rise of cross-border payments illuminates the shifting dynamics of global trade and finance. Despite a move towards deglobalization, the international money transfer market has been growing steadily by 10.4% since 2000. This uptick is fueled by the newly banked populations gaining access to financial services and the need for businesses to navigate disrupted trade routes and fragmented supply chains by reaching out to new international partners.

While domestic payments have embraced the speed of light, international transactions remain entangled in a web of varied regulations, systems, and technological maturity across 195 countries. However, this complexity unveils an opportunity to grease the wheels of the global economic engine. Blockchain technology is at the forefront of this advancement, promising to minimize friction, reduce costs, and increase flexibility.

Understanding Global Payments

The intricacies of international payments are rooted in the network of banks and financial institutions across countries. Direct bank-to-bank transfers are straightforward but limited by the need for pre-existing relationships. More commonly, transactions involve a series of correspondent banks, a practice that has historically prolonged the process. This system of intermediary banks, while ensuring global reach, often introduces delays due to rigorous compliance checks and manual processing steps.

As banks worldwide enhance their communication technologies and network of relationships, this landscape is transforming. SWIFT, the global interbank messaging service, now reports that 84% of payments over its network either directly reach their destination or involve a single intermediary, with a 89% of transactions completed in under an hour.

Embracing Real-Time Global Transactions

Within the confines of domestic economies, Real-Time Payment (RTP) systems represent a paradigm shift, connecting local banks to a centralized, automated settlement mechanism overseen by the national central bank. This framework ensures that domestic payments are not only processed instantaneously but also adhere to a unified set of standards, technologies, and regulations. This has propelled the efficiency of domestic transactions, laying the groundwork for potential economic growth.

However, extending this level of efficiency to the international stage presents a formidable challenge. The attempt to achieve real-time global transactions is hindered by the overwhelming task of aligning diverse payment systems, regulations, and technological standards across countries. The complexity of this harmonization is exacerbated by differing national interests, making direct connections of systems, similar to domestic RTP systems, highly unlikely.

Blockchain: A Leap Towards Instant Settlements

Promising a radical leap forward from (or rather around) existing international settlement systems, blockchain provides an infrastructure capable of supporting instantaneous, global transactions without the conventional complexity. Instead of attempting to connect existing systems, blockchain offers a fresh slate — an independent, global system ready for adoption.

Blockchain’s decentralized nature means it operates outside the traditional banking system, sidestepping the hurdles of technological compatibility, regulatory discrepancies, and the need for bilateral agreements. This promises a future where financial transactions, regardless of geographical boundaries, are as fast and efficient as they already are domestically.

Thanks to its distributed ledger technology (DLT), blockchain also enables secure, instant payment processing between parties. That is why more and more financial institutions are exploring private, closed permissioned blockchains for cross-border transactions. These offer more control and data protection compared to public blockchains.

A blockchain settlement approach not only enhances security but also ensures constant availability — a critical factor for managing international treasury operations in real-time, 24/7. Private blockchains also hold the key to integrating different currencies, like Central Bank Digital Currencies (CBDCs) or stablecoins, into the global payments system.

The Role of Stablecoins in Enhancing Cross-Border Payments

The emergence of stablecoins — digital currencies pegged to stable assets like fiat currencies or gold—is an integral component of blockchain’s potential to revolutionize global transactions.

How?

- Stablecoins present a solution to the volatility typically associated with cryptocurrencies by being pegged to existing assets.

- Their stability, combined with the inherent benefits of blockchain technology (e.g. transparent, security, and immutability), makes them an ideal medium for international trade and finance.

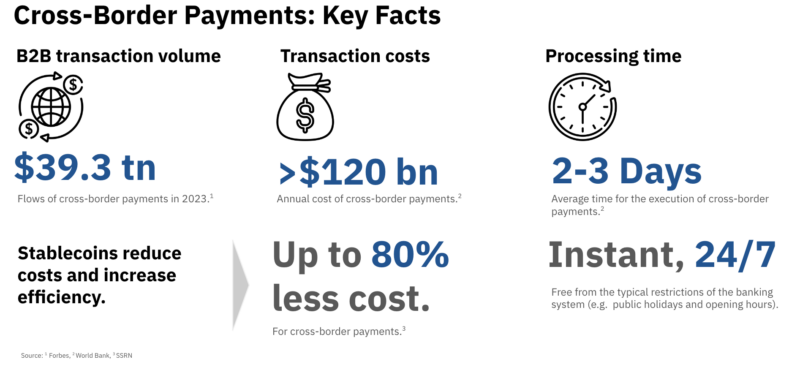

- Because stablecoins enable real-time, cost-effective cross-border payments, they reduce costs for businesses and individuals while significantly speeding up the payment process.

- By removing banks as intermediaries and gatekeepers, cross-border transaction fees are reduced to a minimum. This is another reason why the majority of internationally active banks are currently working on their own stablecoin solutions.

During our hy Web3 Summit in March 2024, Jan-Oliver Sell and Kim Thiede from Coinbase provided an insightful introduction to the role of stablecoins in cross-border payments, highlighting how businesses can reduce transaction fees and accept payments in any cryptocurrency — including volatile tokens. With Coinbase acting as an intermediary, these volatile tokens are automatically converted into a stablecoin before reaching the intended party. This ensures that businesses are exposed only to the stability of the chosen stablecoin, rather than the volatility of the original cryptocurrency. As a result, businesses can accept volatile cryptocurrencies as additional payment options without exposing themselves to additional risk.

Conclusion: A Customer-Centric Approach

As the cross-border payments ecosystem evolves, the focus remains on enhancing customer experience. The end goal goes beyond the technical innovation that blockchain brings to the table: Businesses and individuals should be able to navigate the complexities of international transactions with ease and a sense of reliability. By prioritizing customer needs and leveraging blockchain’s potential, the future of global payments looks like a promising pathway towards a more interconnected and efficient world economy.

Wir bei hy arbeiten an der Schnittstelle von Web3 und der Unternehmenswelt. Wir freuen uns darauf, bereits heute relevante Anwendungen der “Web3/Blockchain/DLT”-Technologie gemeinsam zu evaluieren und umzusetzen. Wir freuen uns auf Deine Nachricht.

*We would like to thank Angelina Berger for her contributions to this article